What Does Insurance Cover When You Have A Fire?

Fire insurance is a type of property insurance. However, it is slightly different as it covers only fire incident situations and has additional benefits. The insurer reimburses the policyholder in accordance with the terms of the insurance policy when a fire breaks out. The after-expense of a fire incident is steep, and the insurance helps to cover that up to repair or restore goods, assets, and property. When purchasing a fire insurance policy, the insurer agrees to bear the expenses of the unforeseen fire incident. But the policyholder needs to pay a premium to avail of the policy coverage.

Contingencies or Perils To Be Covered by Fire Insurance

Fire insurance will cover the loss of damaged or destroyed property that is insured. However, the reason for the fire is very important here. A fire can be triggered due to various reasons, and not all of these perils are covered through the insurance policy. Though some of the coverage may differ in accordance with the insurance company, there are some general contingencies that every fire insurance policy covers.

- General fire

- Wildfire

- Fires sparked by lightning

- Fires caused by an explosion

- Landslides caused incidents

- Fires triggered by electricity

- Fires caused by natural disasters such as storms, hurricanes, floods, typhoons, and more

What is Not Covered in Fire Insurance?

Though fire insurance is said to cover the loss of insured goods and property, some exceptions exist. Some of the common exclusions are:

- Property or goods which is not insured

- In case of arson

- Losses occurred due to invasion, hostilities, or war

- In situations like civil strife and a military uprising

- When a property is vacant for more than 30 days

- Property being set on fire as a result of a government order

What Kind of Property is Covered Under Fire Insurance?

Fire insurance is said to cover both the interior and exterior property. Any insured structured property which is damaged or destroyed by fire is covered by the insurance policy. The insurance also reimburses the cost to repair and restore the property.

Furthermore, the goods and assets which are damaged due to the use of water to extinguish the fire are also under fire insurance coverage. Any adjacent property which is needed to be pulled down is also covered.

What Do I Do To Get My Fire Insurance Cover?

Purchasing fire insurance and getting coverage for it are two different processes. After a fire, there are certain things that need to be followed to actually get the benefit of the insurance. Claiming the insurance with the insurer is the first step you need to follow. Then comes filling out the documents. You need to submit pictures and necessary documents to prove your claim. It is better if you have pictures of them before the incidents. After the insurance company verifies the incident according to your claim, you need to check all the policy terms and conditions of the insurance.

Can I Do The Insurance Coverage Procedure by Myself?

Claiming the insurance cost is the most crucial part of the insurance coverage. If the claiming and the following procedures are not done properly, then you cannot get the maximum benefit of your insurance policy.

For fire insurance coverage, you can try to get the process done by yourself. However, there are several steps to getting insurance coverage, and they are pretty complicated. Suppose, if the documentation is not done properly, you will not get the insurance benefit you are entitled to. Also, checking the policy terms you are gonna get is also important. All these procedures can be overwhelming for you to handle.

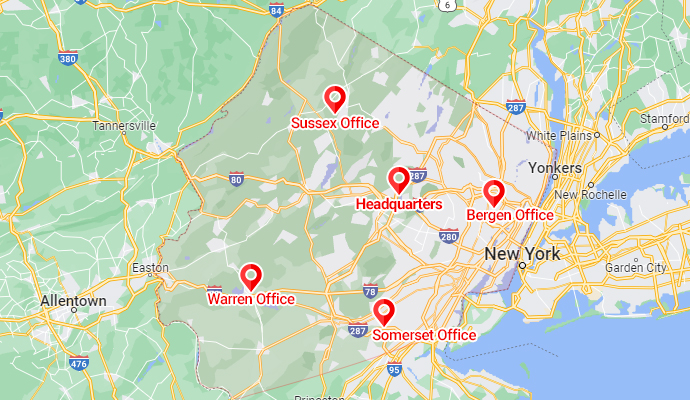

Contacting a reliable restoration company is the best option here. They will repair and restore your property and also help you with the fire insurance claiming and billing. PDQ Fire & Water Damage Restoration is a company that helps you restore your residential and commercial property and also assists you throughout the insurance claiming process. We will help you so that you don’t have to worry about anything missing any details of the whole procedure. We will help you recover from fire and water damage in our New Jersey service area. For more information, contact us via 973-447-3363, or you can also connect online.